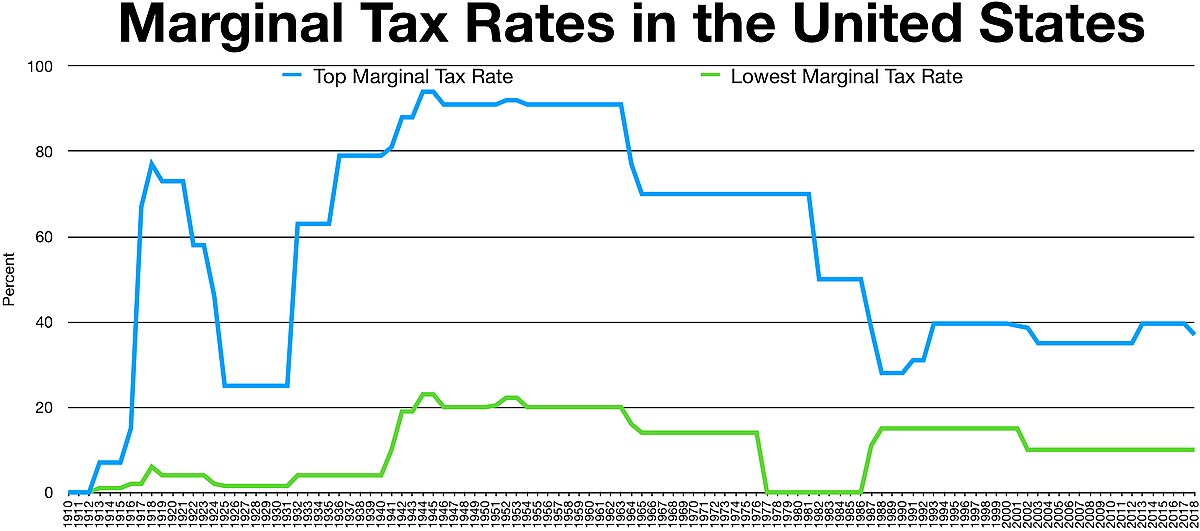

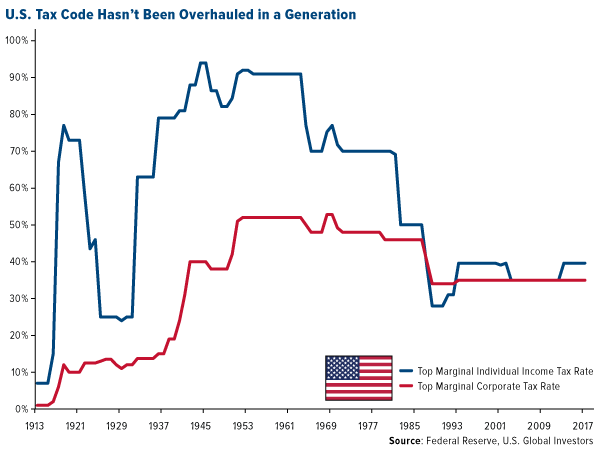

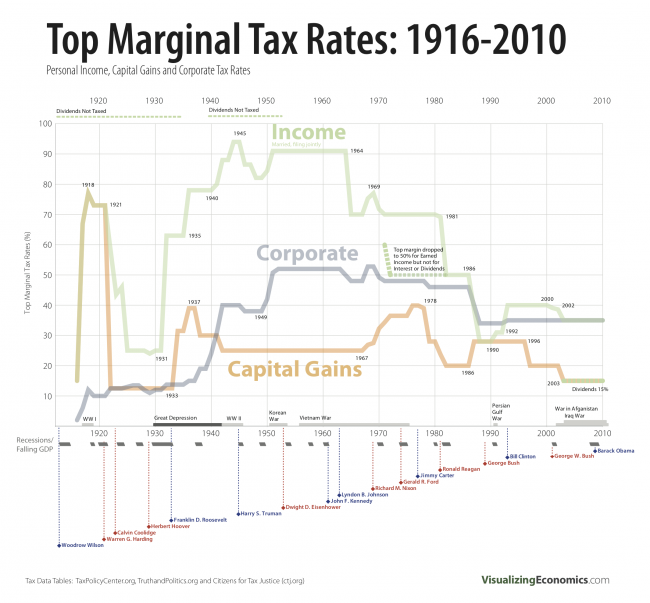

US Top Marginal Income Tax Rates 1913 To 2017: For Individuals vs. Corporations | TopForeignStocks.com

Top marginal income tax rate: United States, France, and Japan, 1981... | Download Scientific Diagram

AFSCME Council 5 - Simply raising the top marginal income tax rate for the wealthiest Americans from 37% to 39.6% would raise $132,000,000,000. That's a lot of investments that can be made

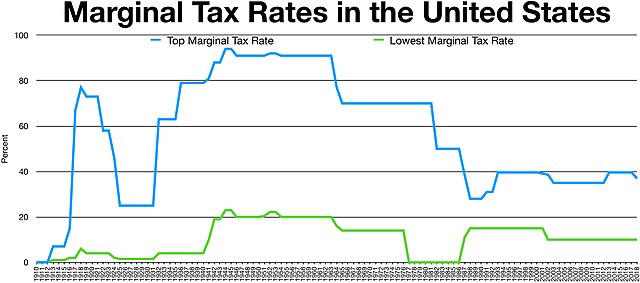

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://imageio.forbes.com/specials-images/imageserve/60868250060f8ad8dd0c97eb/0x0.jpg?format=jpg&crop=1200,675,x0,y225,safe&width=1200)